Mastering the Pocket Option Scalping Strategy for Maximized Profits

If you are searching for effective trading techniques, you’ve come to the right place. The pocket option scalping strategy pocket option scalping strategy is one of the most sought-after methods used by traders to capitalize on short-term price movements. This article will delve into the intricacies of this strategy, helping you understand its mechanics and apply it effectively in your trading endeavors.

Scalping involves making numerous trades in quick succession, aiming to capture small price changes that can lead to significant cumulative gains. This method requires a solid understanding of market dynamics, technical analysis tools, and a disciplined trading approach. In this guide, we will explore the core principles of the pocket option scalping strategy, allowing you to maximize your trading output.

Understanding Scalping

Scalping is a day trading strategy that focuses on small price gaps that are usually created by order flows or spreads. Traders who implement this technique are called scalpers. They aim to “scalp” a small profit on each trade by executing a large number of trades throughout the day. The key to becoming a successful scalper lies in maintaining a low-risk profile and minimizing exposure to market volatility.

Key Characteristics of Scalping

- High Frequency of Trades: Scalpers often make dozens or even hundreds of trades daily, which requires a strong commitment to the trading platform.

- Short Holding Periods: Trades are opened and closed within a few minutes, minimizing market exposure.

- Utilization of Leverage: Scalpers often employ leverage to amplify their profits from small price movements.

- Technical Analysis Focus: Successful scalping heavily relies on charts, indicators, and real-time market data.

Setting Up Your Pocket Option Scalping Strategy

To create an effective pocket option scalping strategy, consider the following steps:

1. Choose the Right Asset

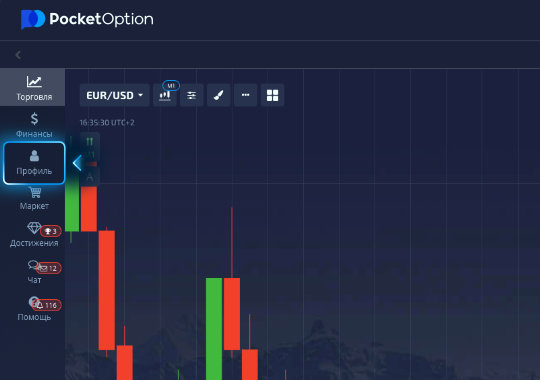

Begin by selecting assets with high liquidity and volatility. Major currency pairs such as EUR/USD or GBP/USD are ideal as they tend to have tight spreads and a high volume of trades. Also, keep an eye on news events that can affect volatility to optimize your trading opportunities.

2. Utilize Technical Indicators

Identify which technical indicators work best for your scalping strategy. Common indicators include:

- Moving Averages: Help identify trends and smooth out price data.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions in the market.

- Bollinger Bands: Show volatility levels and potential price reversals.

3. Set Clear Entry and Exit Rules

Develop a clear set of criteria for entering and exiting trades. This might include specific price levels, indicators, or even timeframes. Your goal is to have a disciplined approach to trading that mitigates emotional decision-making.

Risk Management in Scalping

Effective risk management is vital in scalping. Implement strict stop-loss and take-profit levels to limit potential losses and protect profits. As a general rule, never risk more than 1% of your trading capital on a single trade. This conservative approach ensures that you can withstand several losses without significantly impacting your overall equity.

The Role of Emotions in Scalping

Trading can evoke strong emotions, especially in a fast-paced scalping environment. Maintaining a level head is essential. Here are some tips to manage your emotions:

- Stick to your trading plan and follow it diligently.

- Avoid revenge trading after losses.

- Practice mindfulness techniques to manage stress.

Choosing the Right Trading Platform

Your choice of trading platform is crucial. Ensure that the platform you select offers:

- Low spreads and commissions to maximize profitability.

- Fast execution speeds to capitalize on short-term trades.

- User-friendly interface and reliable customer support.

Final Thoughts

The pocket option scalping strategy can be a lucrative approach for traders who are willing to invest the time and effort required for success. By focusing on technical analysis, maintaining stringent risk management practices, and keeping your emotions in check, you can develop a profitable trading strategy. As with any trading endeavor, practice and experience will play pivotal roles in refining your scalping abilities.

In summary, engage with various resources, backtest your strategies, and continuously learn from your experiences. The world of trading is constantly evolving, and so should your approach. With a thorough understanding of the pocket option scalping strategy, you can position yourself for long-term success in the financial markets.

Leave a Reply