However, a simple tool like Microsoft Excel can be quite handy in making the process easier and faster. The same formula can be copied and replicated in each income statement line, making the calculations much faster. In Figure 5.21, you can see the formulas used to create Clear Lake Sporting Goods’ common-size income statement in Excel. Notice that the $ can be inserted to anchor a cell reference, making it easier to copy and paste the same formula onto many lines or columns. Most accounting computer programs, including QuickBooks, Peachtree, and MAS 90, provide common-size analysis reports. You simply select the appropriate report format and financial statement date, and the system prints the report.

3: Common-Size Financial Statements

- Based on the accounting equation, this also equals total liabilities and shareholders’ equity, making either term interchangeable in the analysis.

- But rather than act as an alarm, this indicates that the company had been hugely successful in generating cash to buy back shares, far exceeding what it had retained on its balance sheet.

- It also allows you to view a horizontal perspective over a period such as the three years that were analyzed in our example.

- Even though common size analysis doesn’t provide as much detail, it can still be effective in analyzing financial statements.

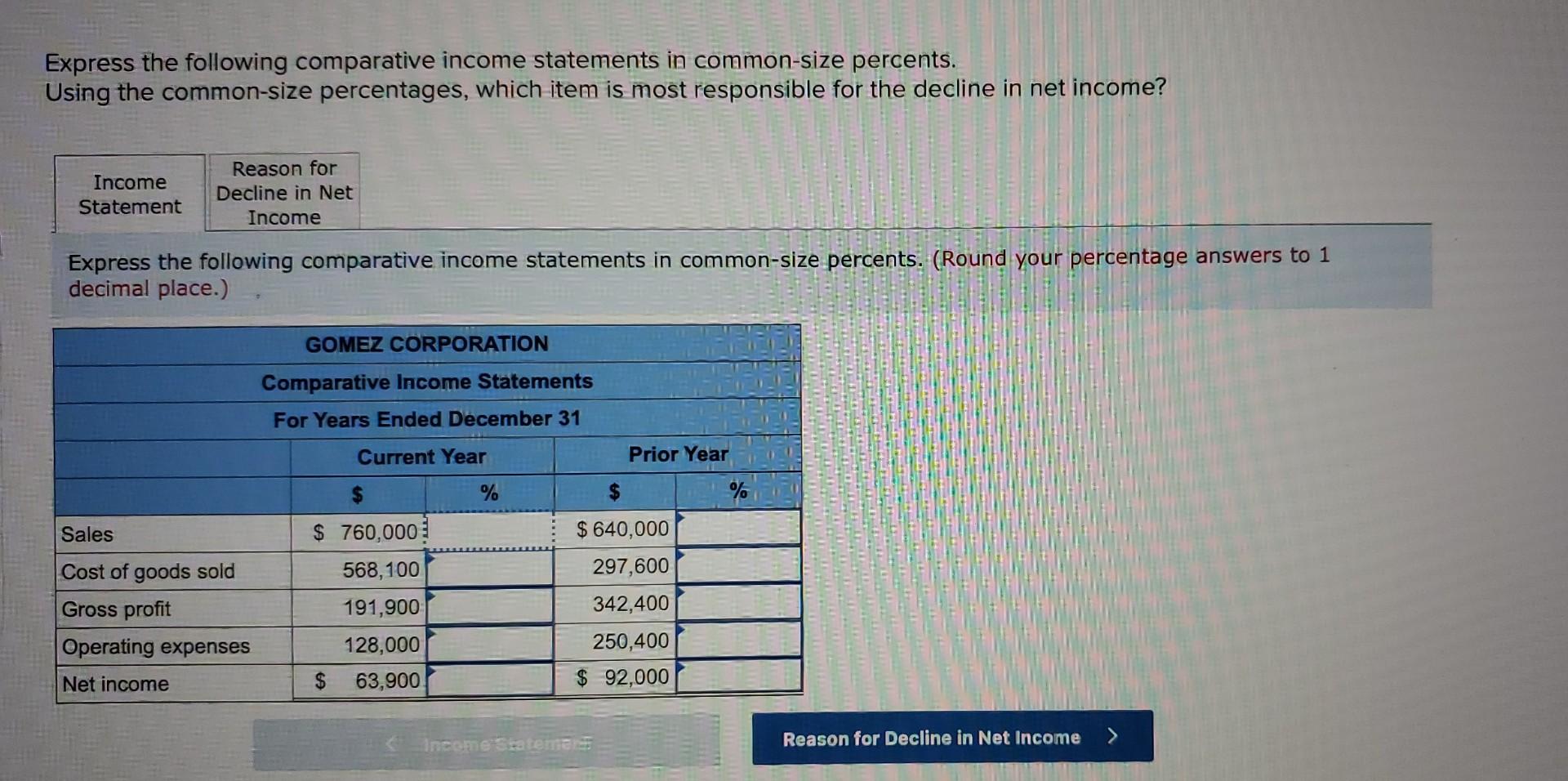

Many items in the cash flow statement can be stated as a percent of total sales, similar to an income statement analysis. This can give insight into several cash flow items, including capital expenditures (CapEx) as a percent of revenue. Based on the accounting equation, this also equals total liabilities and shareholders’ express the items in common-size percents. equity, making either term interchangeable in the analysis. It’s also possible to use total liabilities to indicate where a company’s obligations lie and whether it’s being conservative or risky in managing its debts. A common-size financial statement displays line items as a percentage of one selected or common figure.

Income Statement Common Size Analysis

Generally accepted accounting principles (GAAP) are based on consistency and comparability of financial statements. A common size income statement makes it easier to see what’s driving a company’s profits. The common size percentages also help to show how each line item or component affects the financial position of the company.

Using Common-Size Analysis to Evaluate Trends within a Company

The main difference is that a common size balance sheet lists line items as a percentage of total assets, liability, and equity, which is different from the normal numerical value. A common size financial statement is used to analyze any changes in individual items when it comes to profit and loss. They’re also used to analyze trends in items of expenses and revenues and determine a company’s efficiency. A common size financial statement is a specific type of statement that outlines and presents items as a percentage of a common base figure. The process of creating a common size financial statement is often referred to as a vertical analysis or a common-size analysis.

You can then conclude whether the debt level is too high, if excess cash is being retained on the balance sheet, or if inventories are growing too high. Common-size analysis enables us to compare companies on equal ground, and as this analysis shows, Coca-Cola is outperforming PepsiCo in terms of income statement information. However, as you will learn in this chapter, there are many other measures to consider before concluding that Coca-Cola is winning the financial performance battle.

Common-Size Assets and Common-Size Liabilities and Equity

Rapid increases or decreases will be readily observable, such as a fast drop in reported profits during one quarter or year. Note that although we have compared just two years of data for Charlie and Clear Lake, it is more common to use several years of data to get a more robust view of long-term trends. It’s worth noting that if two companies are using different accounting methods the comparisons might not be accurate. The goodwill level on a balance sheet also helps indicate the extent to which a company has relied on acquisitions for growth. Note that rounding issues sometimes cause subtotals in the percent column to be off by a small amount.

By analyzing how a company’s financial results have changed over time, common size financial statements help investors spot trends that a standard financial statement may not uncover. The most valuable aspect of a common size balance sheet is that it supports ease of comparability. The common size balance sheet shows the makeup of a company’s various assets and liabilities through the presentation of percentages, in addition to absolute dollar values. This affords the ability to quickly compare the historical trend of various line items or categories and provides a baseline for comparison of two firms of different market capitalizations.

The firm did issue additional stock and showed an increase in retained earnings, both totaling a $10,000 increase in equity. However, the equity increase was much smaller than the total increase in liabilities of $40,000. The remainder of that increase is seen in the 5 percent increase in current liabilities. Common size income statements with easy-to-read percentages allow for more consistent and comparable financial statement analysis over time and between competitors. You would do this for each of the other line items to determine the common size income statement figures. It outlines and reports everything from liabilities, assets, and owner equity as a percentage of the sales or assets.

As a result, the financial statement user can more easily compare the financial performance to the company’s peers. For example, you may show merchandise inventory or accounts receivable as a percentage of total assets. The balance sheet uses this presentation on individual items like cash or a group of items like current assets.

Leave a Reply