If you would like to learn more about annuities, check our time value of money calculator or the annuity payout calculator. In the following, we explain what the annuities definition is and show you some annuity examples to provide better insight into how do annuities work. You can also read about the types of annuity and learn the growing annuity formula. People have a lot of options when it comes to selecting the right investments for their portfolios. For this reason, some investors turn to annuities as a safe alternative to protect them from changes in the market. The best way to calculate the future value of an annuity is to simply use a future value of annuity calculator.

\boxed2.2[/latex] Future Value of Ordinary Annuities

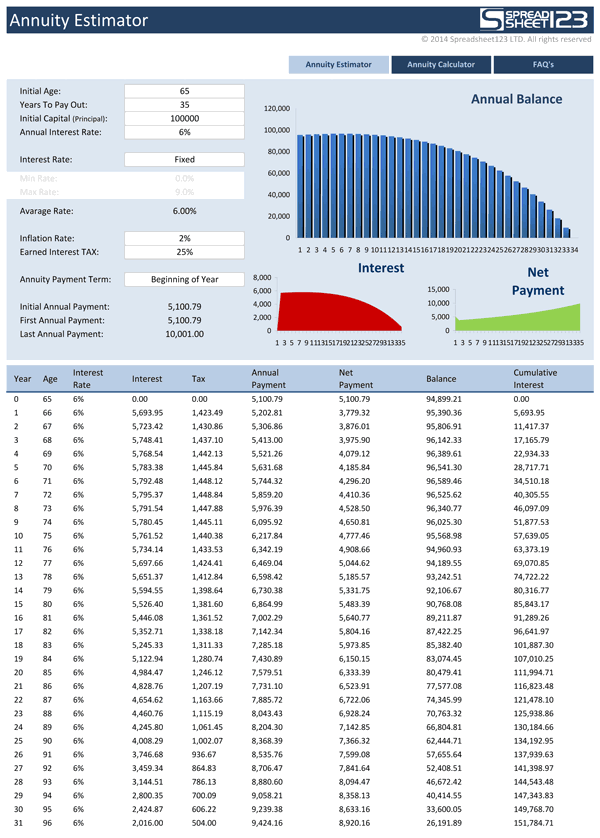

This tool helps individuals estimate how long their savings will last if they were to retire today. It factors in current savings, expected annual withdrawal rate, and other sources of income or expenses. To understand these concepts in real-world scenarios, consider the case of a retirement plan.

Mathematics of Finance

The most important way to differentiate annuities from the view of the present calculator is the timing of the payments. If the payment setting is NOT specified in the question, it is assumed that the payments come at the end of the interval. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies.

Are annuity a good investment?

For example, if you selected a monthly payment frequency, the future value annuity calculator will divide the annual rate by 12. Commissions–Annuities are generally sold by insurance brokers who charge a fee of anywhere from 1% for the most basic annuity to as much as 10% for complex annuities indexed to the stock market. In general, the simpler the annuity structure or the shorter the surrender charge period, the lower the commission.

- The term “annuity” is often used rather broadly within the financial and investment communities, which can create a bit of confusion for consumers.

- An inflation calculator determines the change in the value of money due to inflation over time.

- The value calculated by the ordinary annuity calculator is $ 5,525.64 after 5 years and an interest rate of 5 %.

- A popular example is an income rider; in the case of dramatic drops in the value of mutual fund investments in an annuity, an income rider prevents it from falling below a guaranteed amount.

- These recurring or ongoing payments are technically referred to as annuities (not to be confused with the financial product called an annuity, though the two are related).

But let’s take a look at how the future and present values of these annuities are typically calculated. In a general annuity, the payment frequency and the compounding frequency are not equal ([latex]P/Y \neq C/Y[/latex]). In this situation, the given interest rate must first be converted to the equivalent interest rate where the new compounding frequency equals the payment frequency. Using the equivalent interest rate, calculate the periodic interest rate [latex]i_2[/latex].

What is an annuity due in common life?

While riders are entirely optional add-ons that add specific features to annuities, they are not free, and each will tack on additional fees to an annuity. While rider charges were initially created for variable annuities, they can also be purchased today for fixed or indexed annuities. The future value of annuity calculator is a compact tool that helps you to compute the value of a series of equal cash flows at a future date. In other words, with this annuity calculator, you can estimate the future value of a series of periodic payments.

With a fixed annuity, the owner of the annuity (sometimes referred to as the annuitant) will make either a large lump sum contribution to their annuity or make periodic contributions over time. There are many different types of annuities, including tax-advantaged annuities, fixed or variable rate annuities, annuities that pay out a death benefit to families or last a lifetime, and more. Different annuities serve different purposes, and have pros and cons depending on an individual’s situation. A variable annuity’s performance is affected by the equity market because variable annuities participate in the market. If the investments in a variable annuity underperform, the annuity’s value will decrease; if the investments do well, the annuity’s value will increase. The calculator above can run estimates of a variable annuity’s value with or without surrender charges.

A deferred annuity is the opposite of an immediate annuity—rather than making payments immediately, deferred annuities will make payments at some predetermined date in the future. The broad term “deferred annuity” can apply to both single lump sum payments or continual cash streams. But with an immediate annuity, the annuity holder will simply make a large lump sum payment and will then begin receiving payments almost immediately. These types of annuities are often popular among people who have just retired but have not invested in annuities in the past. Indexed annuities are a class of annuities that determine their payouts based on a pre-selected market index. Rather than having the annuity holder choose their own securities, which is how variable annuities typically work, an indexed annuity’s payouts will be determined by a somewhat fixed bundle.

Most do not have cost-of-living adjustments (COLA), and as a result, their real purchasing power may decline with time. The biggest assumption the calculator makes is that your variable annuity will earn a consistent average rate of return. By design, variable annuities do not earn the same rate of return year after year; if they did, they would be fixed annuities. In real-life scenarios, understanding the Future Value of Annuity calculations is crucial in areas like retirement planning, education savings plans, and long-term investment strategies. For instance, in retirement planning, these calculations help in determining how much to save today to ensure a stable financial future.

Investment Management Fees–Similar to management fees paid to portfolio managers of mutual funds and ETFs, variable annuity investments also require fees to pay portfolio managers. Most people use annuities as supplemental investments in combination with other investments such are 529 contributions tax deductible as IRAs, 401(k)s, or other pension plans. Many people find that as they get older, investment options with tax shields approach or reach their contribution limits. As a result, conservative investment options can be sparse, and buying an annuity can be a viable alternative.

Leave a Reply