Since you may already fully know, the fresh new naysayers had me into twenty-five year financing forgiveness bundle on very first 8 weeks immediately after graduation

Contained in this area, I you will need to target ways that we can reconsider a lifestyle hoping from rescuing a couple of dollars. The present post needless to say pushes the bar, because it’s glaringly apparent for me not most of the domestic comes with the deluxe of having several income. But talking about loans alone makes us the extremely privileged. To have the capacity to access a computer, to have the for you personally to sit-down and read, getting command over where the money goes, for money well worth talking about, speaking of all the most stark privileges versus anybody whose discussions encompass the way to get food available, how exactly to remain the high school students safe. Can i function as first to say that right seeps regarding my entire life as the moment I happened to be produced, and i am hyper conscious of they. Having said that, In my opinion it is important to area the latest privileged with the a direction, in order for we might use money (specifically) to operate a vehicle the brand new needle toward a much better tomorrow, unlike purchase all of our excesses flippantly over superficial some thing to possess now. Conclusively, you should limit the paying of our earnings into simply the things that render joys having permanence, plus one instance treatment for do that should be to dedicate simply one money in order to existence using on cases where discover a few (or more).

While i believe back once again to my personal grandparent’s go out otherwise farther, I find a time when the standard family vibrant away from a good stay-at-household mom and you can a functional father resided. Raising 8 children inside a 3rd community nation away from one money couldn’t was basically easy. Nevertheless they produced ends meet. Even Mike’s grandparents spent my youth to your a farm, along with his great-grandfather buying a great diner you to definitely offered burgers having $0.10 for each and every. His grandmother defines sporting an identical couples shirts per week, and you can keeping their particular dated chairs whilst however properties. My personal granny requires papers bath towels at family unit members events, rinses them, and you can hangs them to lifeless across the sink to have re also-have fun with after. These types of little indications act as reminders which they dont exercise as frugal, but instead, due to the fact which is exactly how they will have usually complete they. It’s a lifetime produced regarding a requirement.

I’m not stating that by doing this regarding way of life no longer exists, since it however largely do. However it is are much less common. Now, it is almost more frequent you to house try twin-income, therefore before we have as well overly enthusiastic rejoicing at big figures of money we are taking household, can i strongly recommend we act as when the none from it has actually ever before changed? Of the as long as i still have to alive as if i generate one earnings, we too can alive so it lives. I am not these are washing your paper towels and you may hanging all of them so you can dead (once the nixing paper bath towels all of the-together is actually the approach to life I’m trying to recommend). I am simply saying, getting less inefficient, of money or other some thing. But particularly, of money.

My greatest gripe with individuals advising myself which i cannot tackle my $575,000 away from student personal debt try the assumption that with a much bigger paycheck will come a richer life. Allow the money grow, and simply waiting 25 years to pay every thing out-of! After all, undoubtedly you will have to value to shop for a grand house, a different automobile, a dentist. I come across all of this the time. People with twice as much income be at ease with supposed over to dining per night, buying the automobiles, purchasing home, hunting all of the couple weeks, racking up personal debt. The people that to consider money, for some reason, be a little more able to get because of the without having any loans. Finest furnished, I would personally say.

Ignore that college loans might possibly be over so many cash off financial obligation by the point the 50 years old loans in New London, you could love all that later on

Mr. Debtist and i both grew up in family members which have just one income. We’d whatever you necessary to alive pleased existence and be ilies just weren’t precisely the richest loved ones in your area. With this particular summation, i decided, better, how lousy can it be when we stayed off that income? Oral is sold with high pay, however, we shall you prefer 100% of that pay money for next 10 years in order to reduce the fresh fund. What if We struggled to obtain free for a decade, supported my personal go out, and we also try to be when it was a single money family enjoy it was through the all of our right up-getting? It can scarcely be controlled life. Do not have any students to consider if your cat does not count, and Mr. Debtist makes adequate money to help with two people conveniently even with life style from inside the Lime County, Ca. Also, we have been easy some one.

It was which bottom line that welcome me to handle your debt. It had been contained in this time period we checked out away the theory: Way of living off of you to income enable me to pay off a financial obligation one no-one more considered we could. They simply grabbed two months to prove so you can our selves one to this can work. The intentionality that have cash is most just what propelled united states down that it street, and now we started to doing things people did not faith we could. Altering financing forgiveness plans could save you several thousand dollars, however, by modifying out of a twenty-five season loan cost so you’re able to tackling beginner debt aggressively, it does rescue united states more than $150,000 bucks, and you will fifteen years of our own lifetime. This is the reason I am happy to exposure the newest flack that I might located on the insensitivity in the blog post.

Because no body informed united states we could. There wasn’t ever the brand new tip to function free-of-charge.Individuals don’t think to write to us to act as if i were an individual-money domestic.They almost felt like i didn’t have an alternative.

It is essential to speak about these things, because it is the only way to encourage somebody. For the majority, it can be noticeable. For other individuals, it could be unpleasant. But for anyone else, still, it can be the one thing that can 100 % free them.

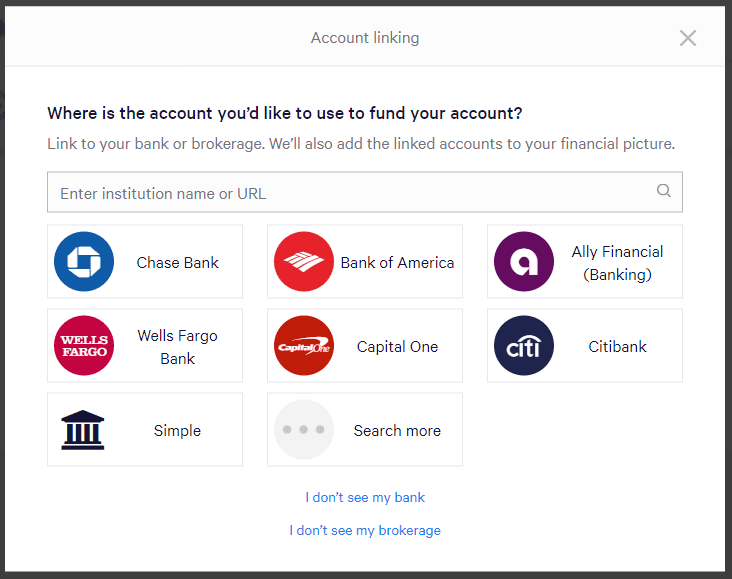

If you would like try and see if using a great single-earnings household is an excellent lifestyle hack for your requirements, just be sure to begin by undertaking a cost management unit!

Leave a Reply