Understanding Exness Trading: A Comprehensive Guide

Trading in financial markets can be both exhilarating and daunting for new investors. Among the platforms available, Exness Trading Exness ٹریڈنگ stands out due to its user-friendly interface, a variety of trading instruments, and competitive spreads. In this article, we will delve into the intricacies of Exness Trading, its benefits, challenges, and strategies to enhance your trading experience.

The Rise of Exness Trading

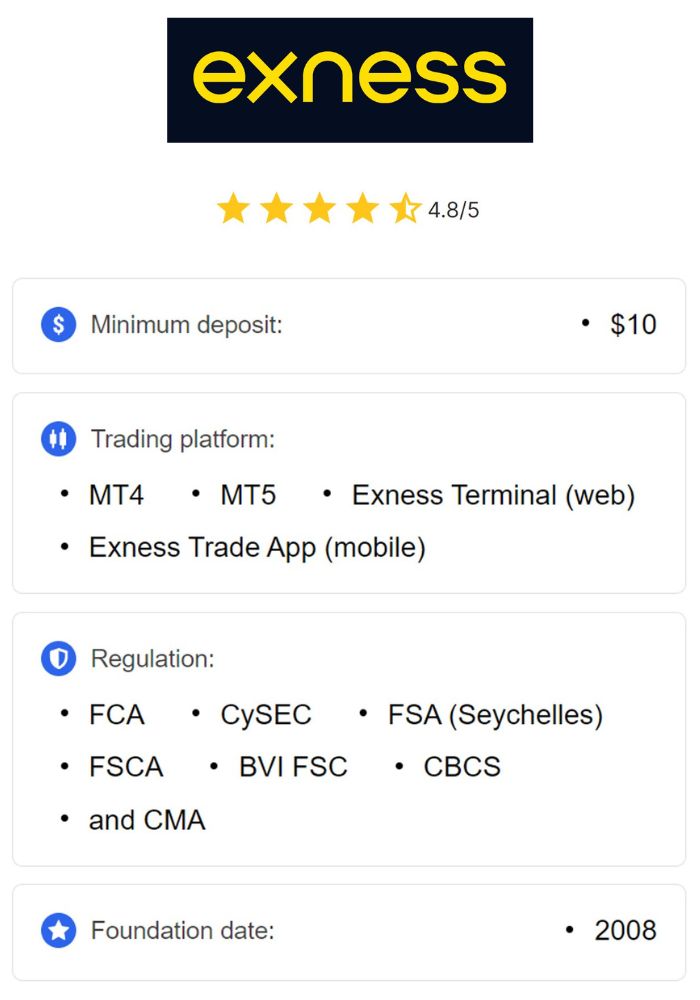

Founded in 2008, Exness has quickly gained traction as a leading broker in the Forex and CFD markets. With its commitment to transparency and customer service, it has attracted millions of traders worldwide. The platform is particularly popular among beginners due to its educational resources and demo accounts that allow users to practice trading without financial risk.

Core Features of Exness Trading

- User-Friendly Interface: Exness provides an intuitive trading platform that caters to both beginners and experienced traders.

- Diverse Asset Range: Traders can access a wide array of financial instruments including Forex, commodities, indices, cryptocurrencies, and stocks.

- Low Spreads: Exness offers competitive spreads, making it easier for traders to maximize their profits.

- Leverage Options: With leverage up to 1:2000, Exness allows traders to control larger positions with a smaller capital outlay.

- Educational Resources: The broker provides a rich library of educational content, including webinars, tutorials, and articles.

Why Choose Exness Trading?

When it comes to selecting a trading platform, several factors come into play, such as regulatory compliance, ease of use, and support. Exness checks all these boxes, making it a preferred choice among traders. Here are some reasons to consider:

1. Regulatory Compliance

Exness is regulated by several authorities, ensuring that it complies with strict standards related to customer protection and service quality. This level of regulation fosters trust and confidence among traders, which is crucial in the financial markets.

2. Excellent Customer Support

A cornerstone of Exness’s success is its customer service. Available 24/7, the support team can assist with everything from account setup to troubleshooting. Users can reach out via chat, email, or phone.

3. Advanced Trading Tools

Exness offers various trading tools that can enhance the trading experience. From technical analysis indicators to trading signals and automated trading options, users are equipped with everything necessary to make informed decisions.

Getting Started with Exness Trading

Here’s a step-by-step guide to starting your trading journey with Exness:

Step 1: Account Registration

Visit the Exness website and register for a trading account. Fill in the necessary personal information, ensuring accuracy while completing the identity verification process.

Step 2: Fund Your Account

Once your account is set up, it’s time to deposit funds. Exness supports multiple payment methods, including bank transfers, credit cards, and e-wallets, making it convenient to get started.

Step 3: Download the Trading Platform

Exness primarily operates on MetaTrader 4 and MetaTrader 5 platforms. Download your preferred platform to begin trading. Both desktop and mobile versions are available to ensure flexibility.

Step 4: Start Trading

With your account funded and the platform ready, you can begin trading. Start by choosing the financial instruments you’re interested in and develop a trading strategy to guide your decisions.

Trading Strategies for Exness

A successful trading career is often built on a solid strategy. Here are some popular trading strategies you might consider when trading with Exness:

1. Scalping

Scalping involves making multiple trades in a day, seeking small gains from each. This approach requires a quick decision-making ability and an understanding of market fluctuations.

2. Day Trading

Similar to scalping, day trading involves entering and exiting trades within a single day. However, day traders typically hold positions for longer than scalpers, allowing for larger price movements.

3. Swing Trading

Swing trading aims to capture short to medium-term gains by taking advantage of market swings. Traders often use technical analysis to identify entry and exit points.

4. Position Trading

Position trading is a long-term approach where traders hold positions for weeks or even months, aiming to benefit from significant market movements.

Managing Risks in Exness Trading

Regardless of your chosen strategy, risk management is critical to your trading success. Here are key practices to consider:

1. Use Stop Loss and Take Profit

Utilize the stop loss and take profit features to automatically close trades at predetermined levels. This helps mitigate potential losses and secure profits.

2. Diversify Your Portfolio

A diversified portfolio can help spread risk. Instead of putting all your capital into one trade, consider allocating funds across different assets.

3. Stay Informed

Market conditions change rapidly. Stay updated on economic news and events that may influence your trades. News can often lead to significant volatility, so being informed is key.

Conclusion

Exness Trading offers traders a robust platform with a plethora of features and resources. Whether you are new to trading or an experienced trader, understanding the intricacies of the platform and implementing sound trading strategies can enhance your trading journey. Always remember to trade responsibly and continually educate yourself to adapt to changing market conditions.

Leave a Reply